Managing finances can be a daunting task, especially for small businesses or individuals. However, having a balance sheet is essential to keep track of your financial health. A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and its net worth (equity).

Creating a balance sheet can be made easier with the use of a printable template. A printable balance sheet template provides a structured format that allows you to input your financial information quickly and easily. This can save you time and ensure accuracy in your financial reporting.

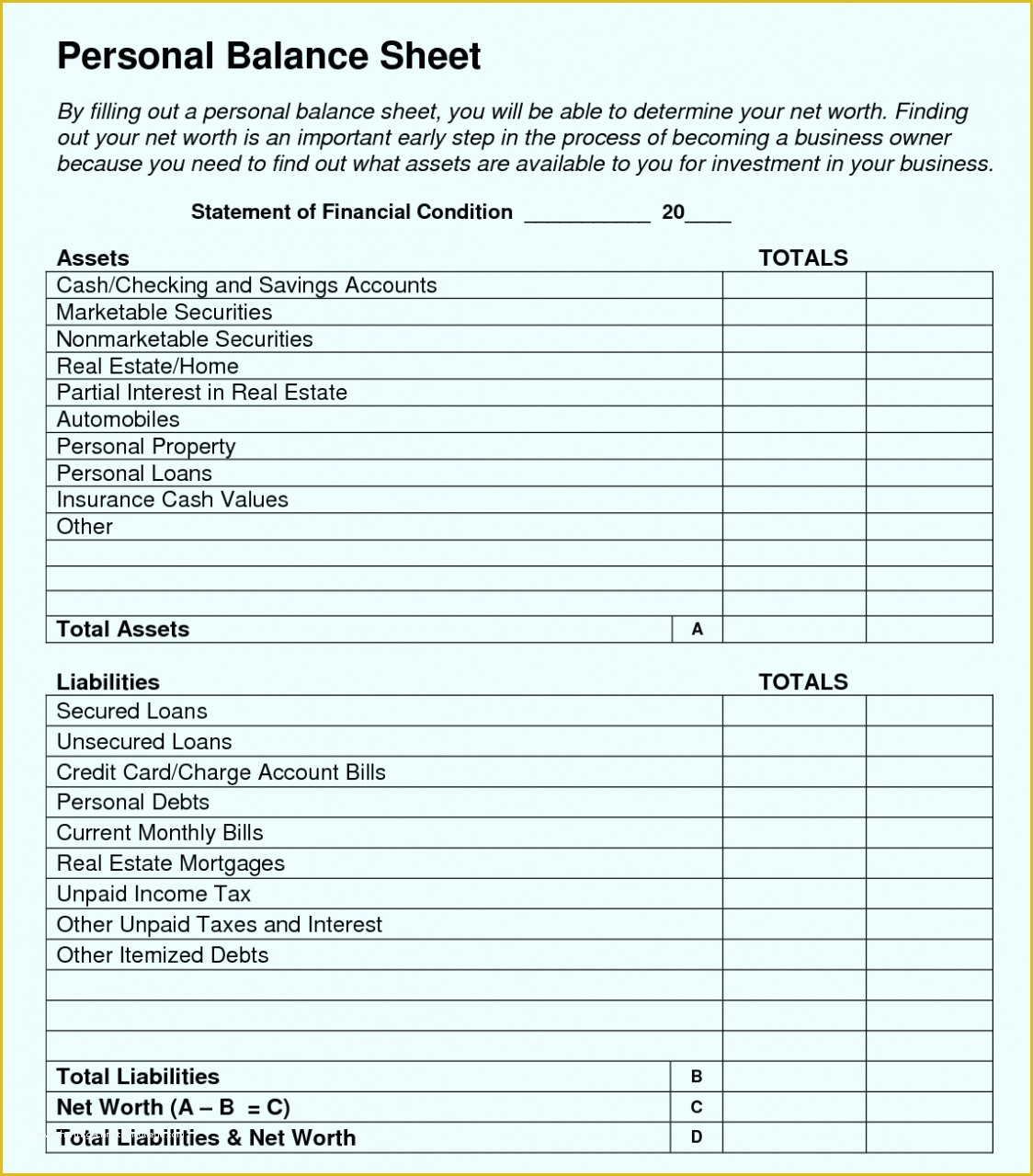

Printable Balance Sheet Template

Printable Balance Sheet Template

Download and Print Printable Balance Sheet Template

With a printable balance sheet template, you can easily organize your assets and liabilities into categories such as current assets, long-term assets, current liabilities, and long-term liabilities. This helps you get a clear picture of your financial standing and identify areas that may need improvement.

Furthermore, a printable balance sheet template can be customized to suit your specific needs. You can add or remove categories, change the layout, or include additional information that is relevant to your financial situation. This flexibility makes it easy to tailor the template to fit your unique circumstances.

Using a printable balance sheet template can also help you track your financial progress over time. By comparing balance sheets from different periods, you can see how your assets, liabilities, and equity have changed. This allows you to identify trends, make informed financial decisions, and set goals for the future.

In conclusion, a printable balance sheet template is a valuable tool for managing your finances effectively. It provides a structured format for organizing your financial information, saves time and ensures accuracy in your reporting, and allows for customization to fit your specific needs. By using a balance sheet template, you can gain a better understanding of your financial position and make informed decisions to achieve your financial goals.