Managing your finances can be a daunting task, but with the help of a monthly budget sheet printable, you can easily track your income and expenses. By having a clear overview of where your money is going each month, you can make informed decisions and ensure that you stay on track with your financial goals.

Whether you are trying to save for a big purchase, pay off debt, or simply want to be more mindful of your spending, a monthly budget sheet printable can be a valuable tool in achieving financial success.

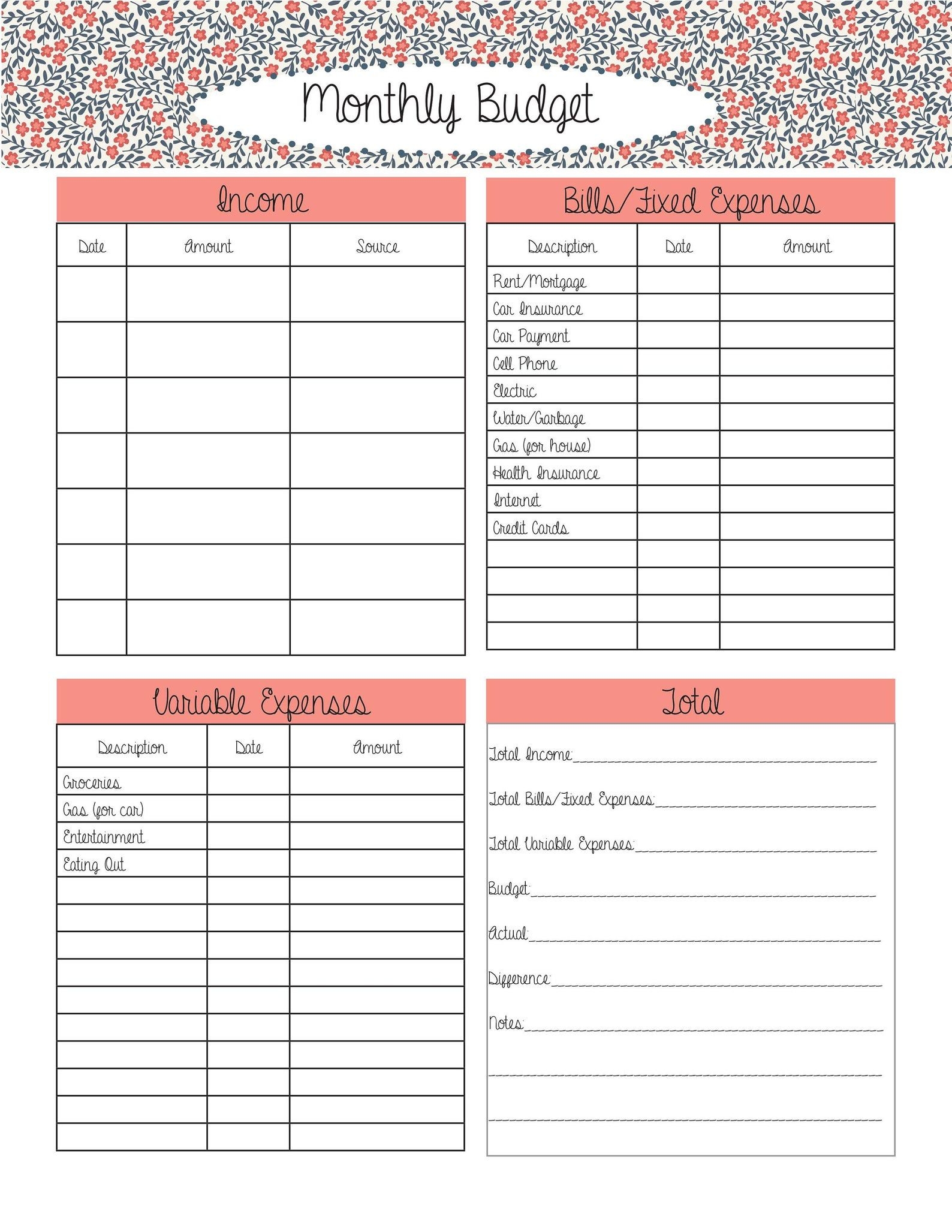

Monthly Budget Sheet Printable

Monthly Budget Sheet Printable

Download and Print Monthly Budget Sheet Printable

Benefits of Using a Monthly Budget Sheet Printable

1. Organization: A monthly budget sheet printable allows you to organize your finances in one convenient place. You can easily track your income, expenses, and savings goals without the need for complicated spreadsheets or software.

2. Planning: With a monthly budget sheet printable, you can plan ahead for upcoming expenses such as bills, groceries, and entertainment. By setting a budget for each category, you can avoid overspending and ensure that you have enough money set aside for important priorities.

3. Awareness: By regularly updating your monthly budget sheet printable, you can gain a better understanding of your spending habits. This awareness can help you identify areas where you may be overspending and make adjustments to reach your financial goals more efficiently.

4. Accountability: A monthly budget sheet printable holds you accountable for your financial decisions. By tracking your income and expenses, you can see where your money is going and make adjustments as needed to stay within your budget.

5. Flexibility: A monthly budget sheet printable can be customized to fit your individual needs and preferences. You can add or remove categories, adjust spending limits, and track your progress towards savings goals in a way that works best for you.

In conclusion, a monthly budget sheet printable is a valuable tool for managing your finances and achieving your financial goals. By staying organized, planning ahead, and maintaining awareness of your spending habits, you can take control of your money and work towards a more secure financial future.